MEXC vs Binance 2025 is the key comparison for traders looking for the best crypto exchange this year. Choosing the right platform can determine your trading success. You want access to various digital assets, low fees, and useful trading tools. Both exchanges have solid reputations, but they differ in important ways like features, costs, and security.

In this review, we cover everything you need to know to make an informed choice. Keep reading to find out which platform gives you better value and trust in every trade. Whether you prioritize low fees, a good user experience, or advanced trading tools, this comparison will help you find the platform that meets your goals.

MEXC vs Binance: A Glance Comparison

| Criteria | MEXC | Binance |

| Best For | Traders seeking access to altcoins, high-leverage options, and copy trading | High-volume traders and those seeking a comprehensive crypto ecosystem |

| Launch Year | 2018 | 2017 |

| Supported Cryptocurrencies | Over 2900+ assets and over 3000 digital pairs, including emerging tokens | 350+ cryptocurrencies |

| Trading Fees | Spot: 0% Maker / 0.05% Taker

Futures: 0% Maker / 0.02% Taker |

Spot: 0.1% Maker / 0.1% Taker

Futures: 0.02% Maker / 0.05% Taker |

| Leverage | Up to 500x on futures trading | Up to 125x on futures trading |

| Key Features | Kickstarter & Launchpad for new tokens, copy trading, and extensive altcoin selection | BNB Chain ecosystem, Launchpad & Launchpool, NFTs, and trading bots |

| Fiat Support | Limited fiat on-ramps, supports P2P trading | Extensive fiat deposit options, including bank transfers and Apple Pay |

| Security | Cold storage, 2FA, Proof of Reserves (PoR), $100M Guardian Fund | Cold storage, 2FA, Secure Asset Fund for Users (SAFU), Proof of Reserves |

| NFT Marketplace | Not available | Available |

| Mobile App | Feature-rich but may feel complex for new users | Intuitive and easy to navigate, ideal for all user levels |

| Global Reach | Available in 170+ countries | Operates in over 180 countries |

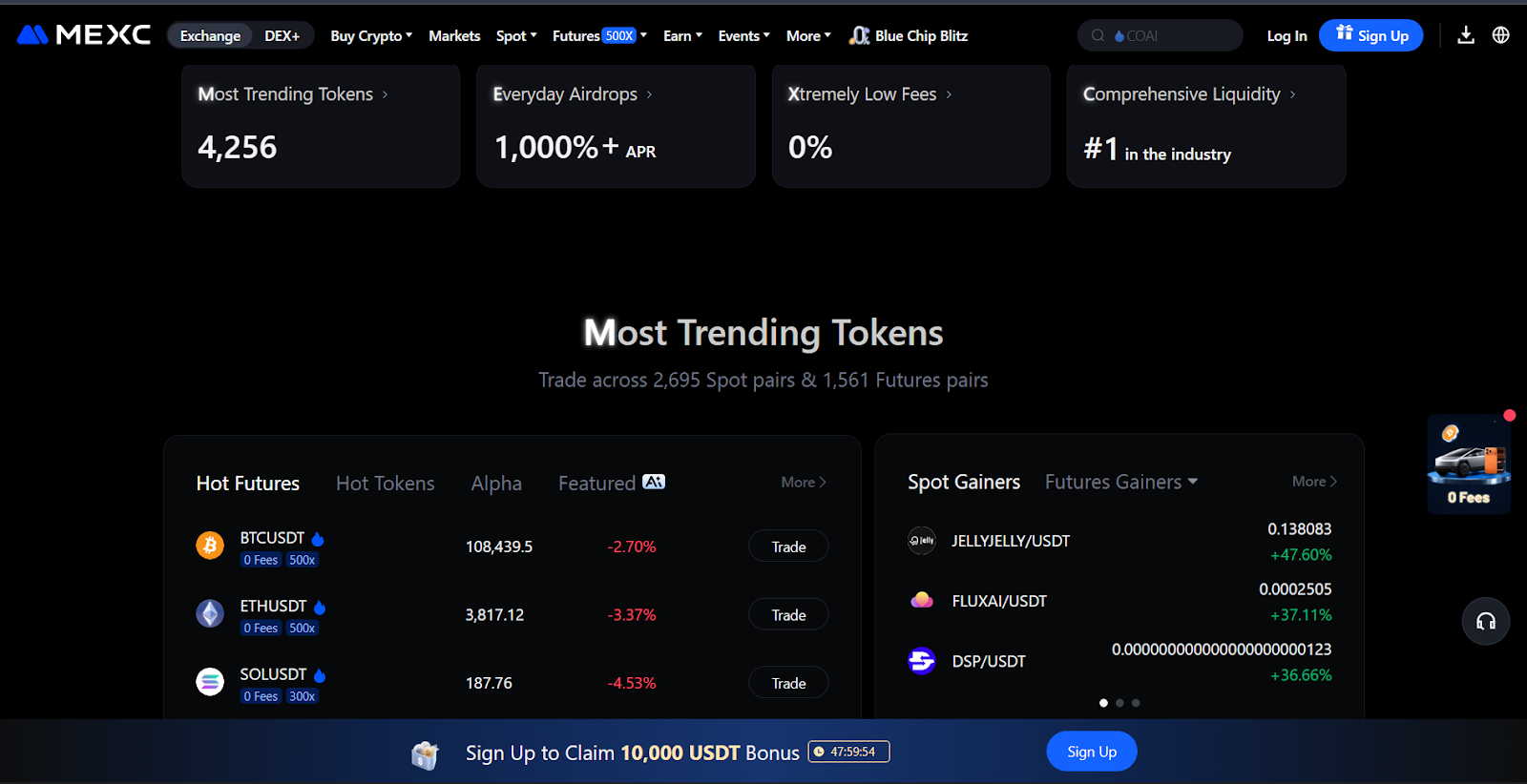

What is MEXC?

If you’re searching for one of the best crypto exchanges, MEXC stands out as a leading choice for traders in 2025. Launched in 2018 and headquartered in Seychelles, MEXC has rapidly grown into a global platform, serving over 30 million users across 170+ countries. Known for its extensive selection of over 3000 trading pairs, MEXC caters to traders seeking both high market cap assets like Bitcoin and Ethereum and newly launched altcoins.

What sets MEXC apart is its high-performance trading engine, capable of processing 1.4 million transactions per second. This ensures a seamless trading experience, even during peak market activity. The platform’s competitive fees, with 0% maker fees on spot trading and up to 500x leverage on futures, make it a go-to choice for traders aiming to maximize their opportunities.

MEXC exchange also excels in early token listings, giving users access to emerging projects before they gain mainstream attention. With billions in daily trading volume and robust security measures like cold storage and Proof of Reserves, MEXC has earned its place among the best crypto exchanges for speed, variety, and innovation.

Pros & Cons of MEXC

| Pros | Cons |

| Traders can access over 2900 cryptocurrencies, including emerging altcoins. | Investors might face challenges with limited fiat currency deposit and withdrawal options. |

| Competitive trading fees, with zero maker fees for both spot and futures trading. | The platform lacks a dedicated NFT marketplace, unlike some competitors. |

| High-leverage futures trading available, offering up to 500x on select pairs. | Margin trading and crypto options are not standalone features. |

| Copy trading allows mexc users to follow and replicate strategies of top traders. | Restricted access in certain regions, including the US and UK. |

| Frequent new token listings provide early access to promising projects. | The user interfaces and features may feel overwhelming for beginners. |

MEXC is best for

- Traders looking to maximize profits with zero maker fees on spot and futures trades.

- High-leverage enthusiasts aiming to amplify their positions with up to 500x leverage.

- New users who appreciate a simple registration process, requiring just an email to get started.

- Investors keen on accessing newly listed tokens before they become widely available.

- Professional traders seeking advanced features like copy trading, demo accounts, and detailed market analysis tools.

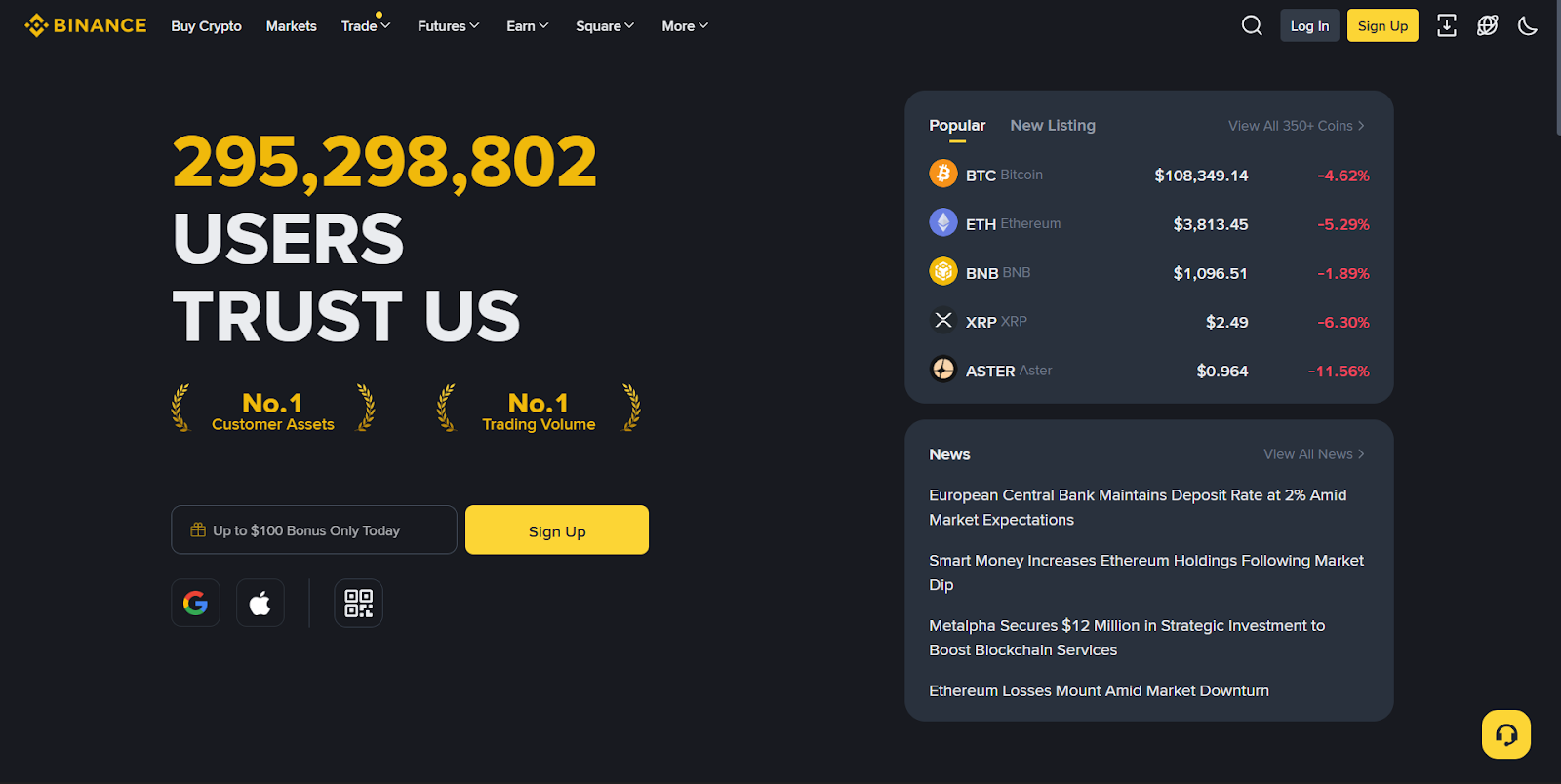

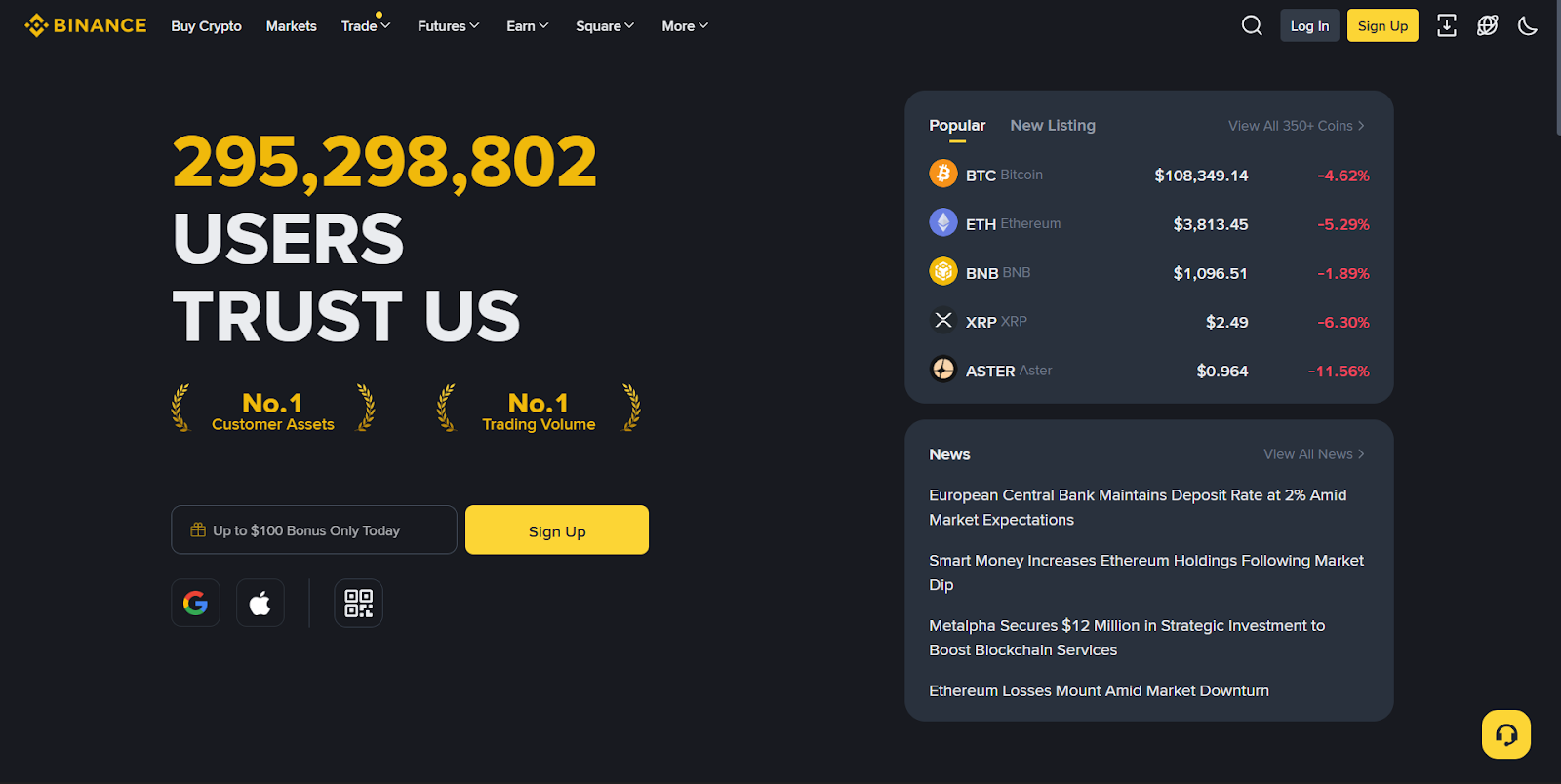

What is Binance?

Binance is a global powerhouse in the cryptocurrency world, setting the standard for what the best cryptocurrency exchanges should offer. Established in 2017, it has grown to serve over 295 million users across 180+ countries, with a daily trading volume exceeding $99 billion.

The platform provides access to 350+ cryptocurrencies, including major coins like Bitcoin and Ethereum, as well as its native BNB token. Binance is renowned for its low trading fees, starting at just 0.1%, and its diverse range of features, such as spot trading, futures, staking, and an NFT marketplace.

Security is a cornerstone of Binance’s operations, with advanced measures like cold storage, two-factor authentication (2FA), and the Secure Asset Fund for Users (SAFU) to protect user assets. Whether you’re a beginner or an experienced trader, there are specific things to look for in a trading platform.

Pros & Cons of Binance

| Pros | Cons |

| Access to 350+ cryptocurrencies, including major coins and altcoins. | The platform can feel overwhelming for beginners due to its vast features. |

| Low trading fees starting at 0.1%, with discounts for BNB holders. | Limited availability in certain regions due to regulatory restrictions. |

| Offers diverse products like staking, NFTs, and margin trading. | Customer support response times can be inconsistent during peak periods. |

| Strong security features, including SAFU and two-factor authentication. | Identity verification is mandatory for most features, which may deter some users. |

| High liquidity ensures smooth trading even for large transactions. | Some advanced tools may have a steep learning curve for new traders. |

Binance is best for

- Traders who prioritize low fees (starting at 0.1%) to optimize their trading costs.

- Advanced traders who need features like futures, margin trading, and in-depth analytics.

- Investors seeking passive income through staking, savings, and liquidity farming.

- High-volume traders who require a platform with deep liquidity for transactions can use either use Binance US or the Binance option available in over 180+ countries.

- Security-conscious users who value robust measures like SAFU and two-factor authentication.

- NFT traders and creators looking for a reliable marketplace to trade and mint NFTs.

MEXC vs Binance: Trading Features

| Feature | MEXC | Binance |

| Spot Trading | Supports a wide range of cryptocurrencies with competitive fees. | 350+ supported coins with high liquidity and low fees (0.1%). |

| Futures Trading | Available with up to 200x leverage on select pairs. | Advanced futures platform with up to 125x leverage and deep liquidity. |

| Margin Trading | Offers margin trading with flexible leverage options. | Comprehensive margin trading with cross and isolated margin modes. |

| Staking & Earn | Provides staking and yield farming for passive income. | Extensive staking, savings, and liquidity farming options. |

| Trading Tools | Basic charting tools and indicators for analysis. | Advanced charting tools, APIs, and trading bots for pro traders. |

| Mobile App | User-friendly app with essential trading features. | Robust mobile app with full trading functionality and advanced tools. |

MEXC vs Binance: Platform Products and Services

| Category | MEXC | Binance |

| Cryptocurrency Listings | Wide range of altcoins, including newly launched tokens. | Extensive selection of 350+ cryptocurrencies, including major, niche and lesser known coins. |

| Launchpad | Token launch platform for early-stage projects. | Industry-leading Launchpad for exclusive token sales and project funding. |

| NFT Marketplace | Limited NFT trading options. | Comprehensive NFT marketplace for buying, selling, and minting NFTs. |

| Savings & Staking | Offers staking and flexible savings for passive income. | Diverse savings, staking, and liquidity farming options. |

| Fiat On/Off-Ramp | Supports fiat deposits and withdrawals in select currencies. | Extensive fiat support with multiple payment methods and currencies. |

| Affiliate Program | Competitive affiliate rewards for referrals. | Robust affiliate and binance referral programs with tiered rewards. |

MEXC vs Binance: Security Comparison

When it comes to security, both MEXC and Binance have implemented strong measures to protect your funds and personal information, but their approaches differ slightly. Binance is widely recognized for its Secure Asset Fund for Users (SAFU), an emergency insurance fund that covers user losses in the event of a security breach. This added layer of protection is a significant advantage for traders who prioritize peace of mind. Binance also employs advanced security features like two-factor authentication (2FA), anti-phishing codes, and withdrawal address whitelisting to ensure account safety. Additionally, its platform undergoes regular security audits to identify and address vulnerabilities.

MEXC, on the other hand, focuses on safeguarding assets through cold wallet storage, where the majority of funds are kept offline to minimize hacking risks. The platform also uses multi-layer encryption to secure transactions and user data. While MEXC doesn’t offer an insurance fund like Binance, its emphasis on cold storage and encryption provides a solid foundation for security.

Both platforms are reliable, but Binance’s comprehensive security tools and insurance fund may appeal more to users who want extra assurance. Ultimately, your choice will depend on whether you value Binance’s additional safeguards or MEXC’s straightforward and effective security measures.

MEXC Security Measures

- Majority of funds stored in cold wallets to minimize hacking risks.

- Multi-layer encryption to secure transactions and user data.

- Regular security audits to identify and fix vulnerabilities.

- IP whitelisting to restrict account access to trusted devices.

- Real-time monitoring systems to detect and prevent suspicious activities.

Binance Security Measures

- Secure Asset Fund for Users (SAFU) to cover losses in case of a breach.

- Two-factor authentication (2FA) for account login and transactions.

- Anti-phishing codes to protect users from fraudulent emails.

- Withdrawal address whitelisting to ensure funds are sent to trusted addresses.

- Advanced risk management systems to monitor and block suspicious activities.

- Regular third-party security audits to maintain platform integrity.

MEXC vs Binance: Affiliate & Referral Programs

| Feature | MEXC | Binance |

| Referral Code | mexc-NFTP | BINANCENFTP |

| Referral Rewards | 10,000 USDT | 100 USDT |

| Affiliate Program | Offers up to 50% commission on trading fees for referred users. | Provides up to 50% commission on trading fees, depending on referral tier. |

| Referral Program | Users can earn rewards by inviting friends, with bonuses in USDT. | Allows users to earn a percentage of trading fees from referrals, with flexible reward structures. |

| Payout Frequency | Commissions rates are credited daily to the affiliate’s account. | Commissions are credited daily to the affiliate’s account. |

| Additional Benefits | Exclusive promotions and bonuses for top-performing affiliates. | Offers tiered rewards and exclusive benefits for high-performing affiliates. |

| Ease of Use | Simple dashboard for tracking referrals and earnings. | Advanced dashboard with detailed analytics and tracking tools. |

Pro Tip: Depending on your preferred crypto exchange, you can use the current MEXC referral code or Binance referral code to sign up and claim exclusive rewards, bonuses, and trading discounts.

MEXC vs Binance: User Experience

When you choose between MEXC and Binance, you gain access to two of the best trading platforms offering excellent leverage. MEXC is tailored for simplicity and accessibility, making it a great option for beginners. Its user friendly interface allows users to easily navigate trading pairs, markets, and account settings. The mobile app reflects this simplicity, offering essential trading features without overwhelming users. However, advanced traders might find the platform’s lack of sophisticated tools and analytics limiting.

Binance, on the other hand, is designed to accommodate both beginners and experienced traders. Its interface strikes a balance between usability and functionality, featuring customizable dashboards and advanced charting tools for detailed market analysis. The Binance mobile app is robust, providing full trading capabilities, including spot, futures, and margin trading, as well as staking and earning options. While feature-rich, the platform’s extensive options can feel overwhelming for new users, requiring time to fully explore and utilize.

Both platforms offer multilingual support, but Binance stands out with its 24/7 live chat and comprehensive help center. MEXC provides email support and a chatbot, which are effective but may not match Binance’s speed and depth of assistance.

MEXC vs Binance: Customer Support

The choice of your cryptocurrency exchange can make a big difference when it comes to customer service. If you ever run into issues, you’ll want a platform that’s quick to help and easy to reach.MEXC offers customer support through email and a chatbot. The chatbot is great for simple questions, but for more complicated problems, you’ll need to rely on email. This can take longer to get resolved, which might be frustrating if you’re in a hurry. While MEXC does provide a help center with FAQs and guides, the lack of live chat support means you might not get immediate answers when you need them most.

With Binance, you get a 24/7 live chat feature, which is useful for live trading. You can connect with a real person anytime, which is a lifesaver for urgent issues like account access or transaction errors. Binance also has a detailed help center packed with articles, tutorials, and videos to guide you through common problems. Plus, their multilingual support ensures you can get help in your preferred language.

If you’re looking for basic support, MEXC gets the job done. But if you value quick responses and a more robust system, Binance stands out as one of the best crypto exchanges for customer service. It’s built to make sure you’re never left waiting for answers.

Conclusion

As an investor, your best crypto exchanges can be those that meet your specific trading needs, whether you’re a beginner or an experienced trader. Both MEXC and Binance are strong platforms, offering unique features to cater to different preferences. With MEXC, you get a straightforward and beginner-friendly platform. Its simple interface and easy navigation make it ideal for those new to crypto trading or looking for simplicity. The platform has helpful tools and resources. However, experienced traders might find the lack of advanced features and live chat support a bit limiting.

With Binance, you get a feature-packed platform that caters to a wide range of users. It offers advanced trading tools, a comprehensive help center, and 24/7 live chat support for quick assistance. While the platform’s extensive options can feel overwhelming at first, it provides the depth and flexibility that experienced traders often seek.

Both platforms are reliable and secure, making them excellent choices in the crypto space. The decision depends on what you prioritize, whether it’s simplicity and ease of use or a more robust and feature-rich trading experience.

FAQs

What exchange is better than Binance?

The answer to what exchange is better than Binance depends on your needs. Binance is known for its advanced features, wide range of cryptocurrencies, and 24/7 live chat support. However, if you prefer a simpler platform, MEXC might be a better fit for you.

Which exchange has lower fees: MEXC vs Binance?

When comparing fees between MEXC and Binance, both platforms offer competitive rates. Binance generally has slightly lower trading fees, especially if you use BNB (Binance Coin) for discounts. MEXC, however, may have promotions or fee structures that appeal to specific traders.

Which exchange is more beginner-friendly: MEXC or Binance?

If you’re looking for a beginner-friendly exchange, MEXC is often considered easier to navigate due to its straightforward trading interface. Binance, while feature-rich, can feel overwhelming for new users but offers extensive tutorials and guides to help you get started.

Which exchange is safer: MEXC vs Binance?

When it comes to safety, both MEXC and Binance implement strong security measures, including two-factor authentication (2FA) and cold storage for user funds. Binance has a longer track record and additional features like its Secure Asset Fund for Users (SAFU), which provides extra protection.

Which is best for advanced traders: MEXC vs Binance?

For advanced crypto traders, Binance is often the preferred choice due to its wide range of trading tools, futures, margin trading, and advanced charting options. MEXC also offers features for experienced traders, but may not match Binance’s depth.

Does MEXC or Binance have better customer support?

When comparing customer support, Binance offers 24/7 live chat, making it more accessible for immediate assistance. MEXC provides email support and a chatbot, which are effective but may not be as fast for urgent issues.